Apple Pay is a convenient and secure mobile payment service that makes it easy to shop with your Apple device.

While Apple Pay is great, it only serves as a wallet that securely “holds”all of your cards. People who don’t need interest rates can still opt for other payment options such as buy now, pay later (BNPL). Luckily, Apple plans to introduce its own BNPL service called Apple Pay Later.

Apple originally announced during WWDC in June that Apple Pay Later would be coming with iOS 16. However, the iOS 16 page now mentions in a footnote that the feature will “come in a future update.”

While Apple has yet to roll out the new payment feature, here’s everything you need to know about the Apple Pay Later step.

What is Apple Buy Now, Pay Later?

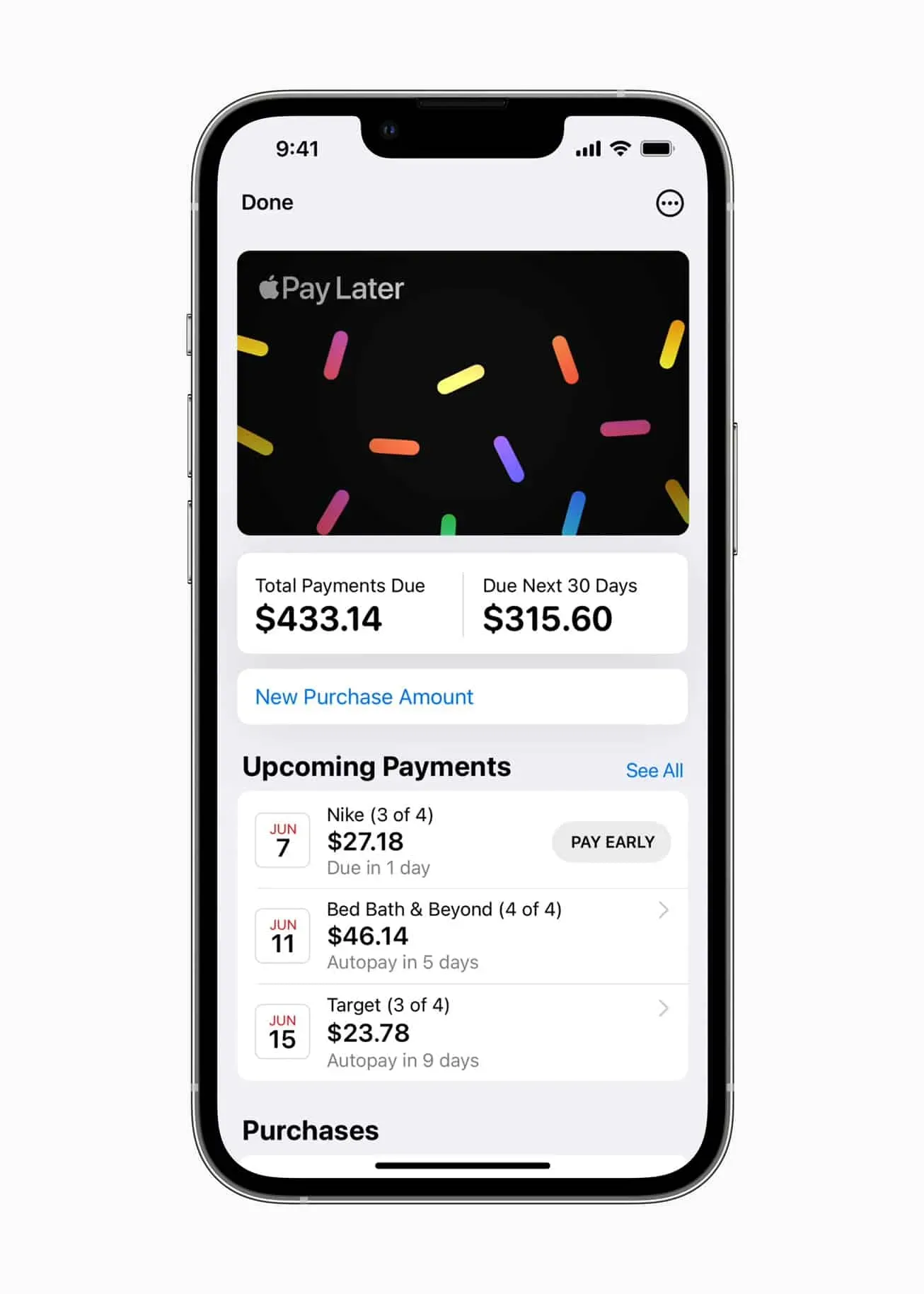

Apple Pay Later in the Wallet app / Source: Apple

Apple Pay Later is a future feature that allows you to make purchases with Apple Pay and pay off over time.

It is available for all online and in-app purchases made with Apple Pay. Bonus? With Apple Pay Later, you don’t have to worry about interest or fees.

Like Apple Pay, Apple Cash, and Apple Card, the new feature is built into the Apple Wallet app. This makes it easy for you to keep track of what you owe and when they owe.

When will Apple Pay Later be available on iPhone?

The launch date of Apple Pay Later is not yet known. The tech giant only vaguely stated that “an update is expected in the future.”This is in contrast to other unreleased iOS 16 features listed on the iOS 16 page.

For example, Wallet key exchange or Matter support in the Home app will be “coming in an update later this year.”

How Apple Pay Later will work

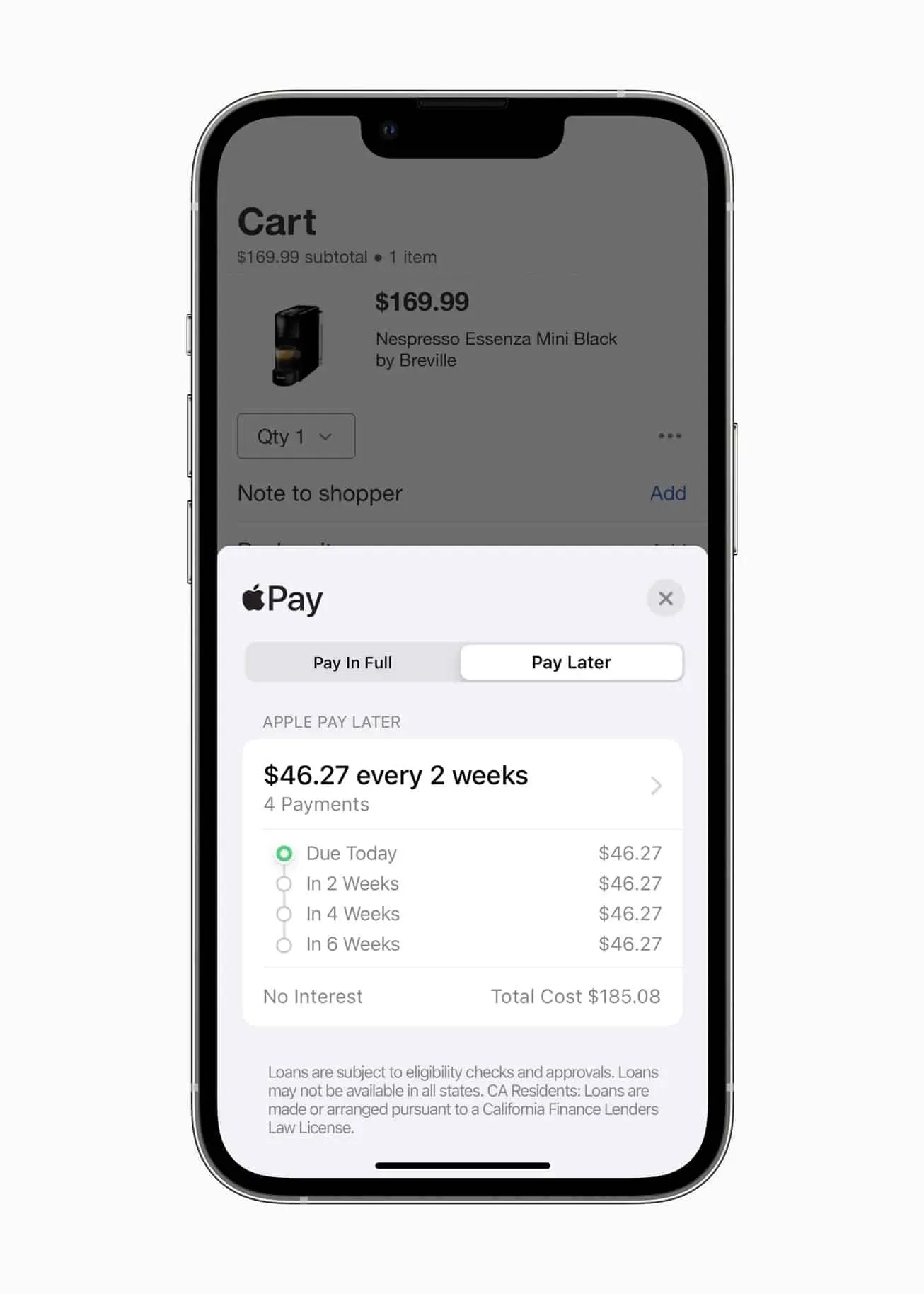

Apple’s “Buy Now, Pay Later”repayment schedule / Source: Apple

Apple’s Buy Now, Pay Later feature, also known as Apple Pay Later, allows you to shop online and make in-app purchases with Apple Pay. The cost is divided into four equal installments, with the bill spread over six weeks.

The first payment must be made upon purchase and subsequent payments must be made every two weeks after the date of purchase.

As soon as the feature is released, you will see two tabs: “Pay in full”or “Pay later”. If you select “Pay Later”, you will be shown a payment schedule (every two weeks) and a breakdown of payments into four equal installments.

If you’re a store or merchant owner, you don’t need any integrations for “Apply Payment Later”as transactions will still be done through Apple Pay. However, domestic payments will be different.

Instead of directly receiving full payment from a person, MasterCard provides payment in installments to merchants. Meanwhile, Goldman Sachs will be the official issuer of the loan. Apple has also created its own financial subsidiary called Apple Financial Services, which handles all credit checks and loan approvals.

Note that Apple Pay Later is essentially a lending service. This means that you will need to apply for and get approved by Apple before using this service. Apple will first run a credit check before deciding whether or not to offer you a loan.

Apple has yet to announce minimum and maximum purchase amounts, but CNET expects the range to be between $25 and $1,000.

Apple Pay Later payment management and order tracking

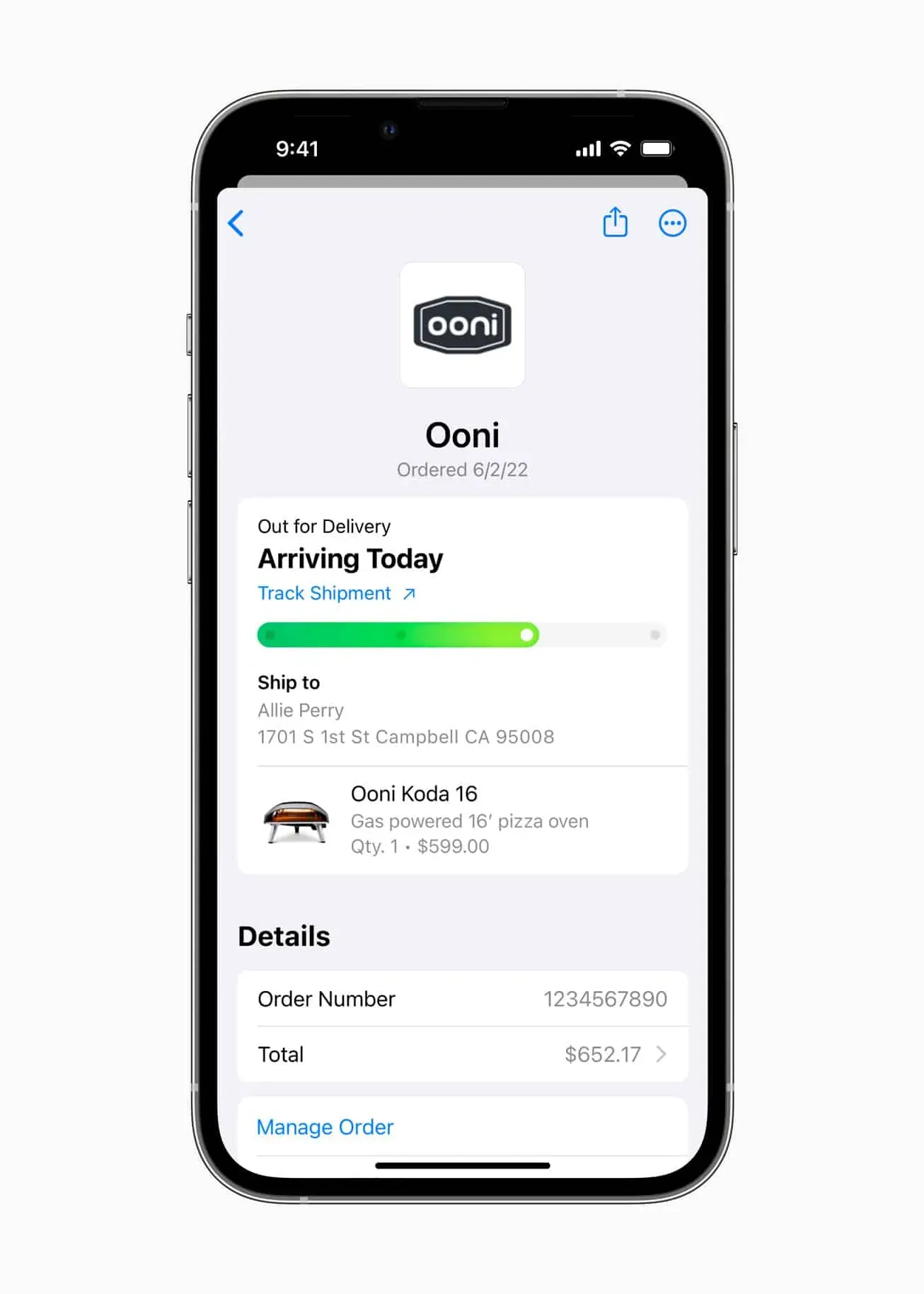

Apple Wallet Order Tracking / Source: Apple

Once you’ve made a purchase, you’ll be able to manage your payments in the Wallet app. You will most likely see a payment schedule shown to you before confirming your purchase, which includes the total amount and upcoming payments.

Apple Pay Later payments are made with debit cards; this will not work with credit cards. It allows you to make additional payments at any time and set up automatic payments. Unfortunately, this also means that regular and timely payments will not improve your credit score.

Where can I use Apple’s Buy Now, Pay Later?

Apple will only be available to eligible applicants in the US. It may not be available in every state. Also, you can only use it for online purchases and apps on iPhone and iPad.

While Apple will likely be working on making the feature available to other countries, there is no word yet on which countries will be next in line.

This feature will work for any store and app that supports Apple Pay purchases. Some of the stores that support Apple Pay include:

- Costco

- Target

- Best Buy

- Airbnb

- Chevron

- Disney

- Dunkin’ donuts

You can’t use Apple Pay at Walmart (because it wants you to use Walmart Pay instead).

Check out the best iPhone apps that support Apple Pay and the full list of stores accepting Apple Pay in 2022.

In small print, Apple indicates that Pay Later will only work for apps and online purchases made on the iPhone and iPad.

Apple Pay Later vs. monthly Apple Card payments

Both Apple Card monthly payments and Apple Pay Later allow you to pay in installments.

Apple Card monthly payments are Apple’s way of helping you finance the purchase of certain Apple products. Financing conditions vary depending on the product you wish to purchase.

Meanwhile, Apple Pay Later is not limited to Apple products. You can use it for both apps and online transactions that accept Apple Pay. This does not require the use of an Apple Card, but does require that you fund your expenses with a debit card.

They also differ in installment period. Apple Pay Later is limited to six weeks, while monthly Apple Card payments can offer up to 24 months of monthly payments.

FAQ

No. Apple Pay Later does not charge a fee even for late payments. However, late payments may prevent you from getting future BNPL loans from Apple.

No. Apple Pay Later has no fees.

Completion…

Apple Pay Later is a great feature for those who want to make a purchase but are currently on a budget. However, it’s important to note that Apple Pay Later isn’t just a new update to Apple Wallet – it’s a brand new financial service offered by Apple.

What do you think of Apple Pay Later? Will you use it? Share your thoughts below!