Apple’s new deferred pay service lets you split your purchases into four payments within six weeks with no interest or fees.

- What’s happening? After several months of delays, Apple has unveiled a preview of the Apple Pay Later feature ahead of a wider launch.

- Why care? Apple Pay Later lets you split your purchases into four payments within six weeks with no interest or fees.

- What to do? Accept Apple’s invitation if it reaches your inbox.

Apple Pay Later preview debuts in the US

On March 28, 2023, Apple began sending email invitations to randomly selected users to use the Apple Pay Later Preview via their Apple ID. This feature is available for online and in-app purchases on iPhone with iOS 16.4 or later and iPad with iPadOS 16.4 or later (Mac not supported).

The company will eventually offer Apple Pay Later to all eligible users “in the coming months,”according to an announcement posted to Apple Newsroom.

Apple Pay Later will automatically appear on your device as an option when paying online and in apps. Goldman Sachs is the official issuer of Mastercard payment information used to make purchases with Apple Pay Later.

How does Apple Pay Later work?

Credits ranging from $50 to $1,000 are available for online and in-app purchases via Apple Pay. You can apply for a loan in the Wallet app without affecting your credit.

You’ll need to link a debit card from the Wallet app to use it as a credit repayment method for Apple Pay Later. Apple doesn’t want you to bite off more than you can chew, so it won’t let you link a credit card to use with Apple Pay Later.

“A soft loan will be made during the application process to help the user make sure they are in a good financial position before taking out a loan,” Apple notes. Once approved, you can apply for a loan right during the checkout process.

The Wallet app will prompt you for upcoming payments. You will also receive email alerts if you have ignored this important Wallet notification.

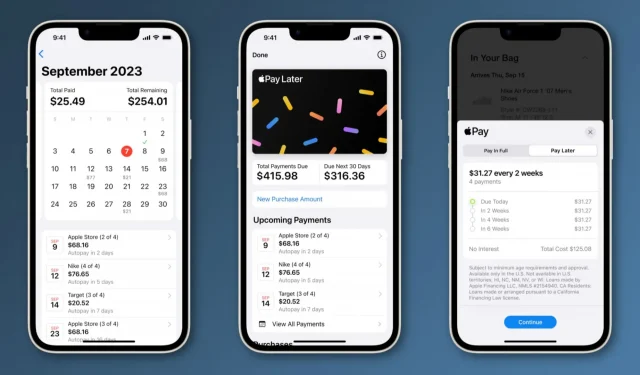

Credit management in the Wallet app

You can manage your credits in the Wallet app, including:

- See the total amount of all your existing loans

- See the total amount due for the next 30 days

- View all upcoming payments in a calendar

Apple Pay Later FAQ

Where is Apple Pay Later available?

Apple Pay Later is currently only available in the US. Apple hasn’t said when this feature might roll out to other countries. Check Apple’s iOS Feature Availability web page from time to time to see if this feature has been expanded to other countries.

Who is eligible for Apple Pay Later?

Apple will determine who is eligible for Apple Pay later in the pre-release phase. The company plans to offer this feature to all eligible users in the coming months. The Apple Support document provides more information about the service, including how to apply for Apple Pay Later credit and make a purchase.

What are the system requirements for Apple Pay Later?

Apple Pay Later is compatible with iPhones running iOS 16.4 or later and iPads running iPadOS 16.4. Mac computers do not currently support Apple Pay Later.

What does Apple Financing LLC do?

Apple Pay Later is the result of a collaboration between the Mastercard Installment Program and Apple Financing LLC, Apple’s credit scoring and lending subsidiary.

Do US credit bureaus know about your Apple Pay Later loans?

Starting this fall, Apple Financing will report Apple Pay Later loans to the US credit bureaus so they show up in people’s general financial profiles. This “will help promote responsible lending for both the lender and the borrower,”says Apple.

How can merchants offer Apple Pay Later?

Merchants who already use Apple Pay don’t need to do anything to start accepting Apple Pay Later transactions. However, as Apple states, “Some merchants may not be eligible to offer Apple Pay Later.”