To open and maintain an Apple Savings account on your iPhone, you must:

- Add an active Apple Card to the Wallet app.

- Be over 18

- Be a US resident residing at a valid physical address in the US.

- Have a Social Security Number or Individual Taxpayer Identification Number

- Turn on two-factor authentication for your Apple ID and update your iPhone to iOS 16.4 or later.

Apple has always strived to build a solid foundation for its limited ecosystem. It has already introduced integrated payment methods by introducing the Apple credit card and Apple Pay Later. Now, with iOS 16.4, Apple has launched the Apple Savings account feature, making the “all Apple”experience even better. Here I will walk you through how you can set up and use an Apple Savings account on your iPhone.

What is an Apple Savings Account?

A small but important amendment to the terms of the Apple Card first concerned the Apple Savings Account. Then, in October 2022, Apple issued a press release announcing the new feature. Finally, on April 17, 2023, this feature was launched in the Wallet app for Apple Card holders.

Apple has partnered with Goldman Sachs Bank USA, an FDIC member, to help users increase their daily cash, cash back incentives for using an Apple credit card, and earn high-yield interest of 4.15% per annum. First, APY stands for annual income as a percentage. In addition, all savings accounts will receive a monthly loan on accrued interest, which is compounded daily.

You can also link your external bank account to your Apple Savings account and transfer money. In addition, there is no minimum deposit, balance limit or cost on the account. The FDIC insures deposits made to Apple Savings up to $250,000, which is also the maximum deposit you can make. According to Apple,

“Savings helps our users get even more out of their favorite Apple Card benefit, Daily Cash, while providing them with an easy way to save money every day. Our goal is to create tools to help users lead a healthier financial life, and embedding Savings with Apple Card in Wallet will allow them to spend, send and store Daily Cash directly and seamlessly, all from one place.”

Jennifer Bailey, VP of Apple Pay and Apple Wallet

Now that you have a basic understanding of your Apple Card savings account, let’s learn how to set up savings in the Wallet app.

How to Set Up an Apple Savings Account on iPhone

- Open the Wallet app on iPhone → select Apple Card.

- Tap the three dots icon → select Daily Cash.

- Select Customize next to Savings.

- Sign the required agreements and follow the on-screen instructions to complete the process.

That’s all! Alternatively, the home page may contain a promotional button for opening a savings account. Touch it and follow the instructions on the screen.

You will then be prompted to transfer money from your Apple Cash balance to a new savings account to begin earning interest.

- Click the Close button if you choose not to transfer your Apple Cash balance.

- To transfer money, select Transfer Apple Cash and follow the on-screen instructions.

As stated earlier, only Apple Card holders and co-owners can create savings accounts and access their Wallet account and balance information. Although it is more like a bank, the registration procedure is quite simple and easy to manage.

How Apple Savings Account Actually Works

As soon as you register a savings account, all your daily funds will be automatically credited to this account. So you earn interest on the cash back you get as a refund on your Apple Card purchases. You can also transfer funds from an external bank account or Apple Cash contributions to receive high-yield interest.

Apple has made banking competition fierce as the 4.15% interest rate is more than ten times the average interest rate. In the US, a typical savings account brings in less than 0.50%.

But remember that you can’t access savings money directly with Apple Card or Apple Pay. You must transfer money from Savings to Apple Cash or a connected external bank account in order to spend the interest money or gift it to a friend. Don’t worry! Apple will not charge transaction fees when withdrawing money.

How to View the Balance and Interest Received in Your Apple Savings Account

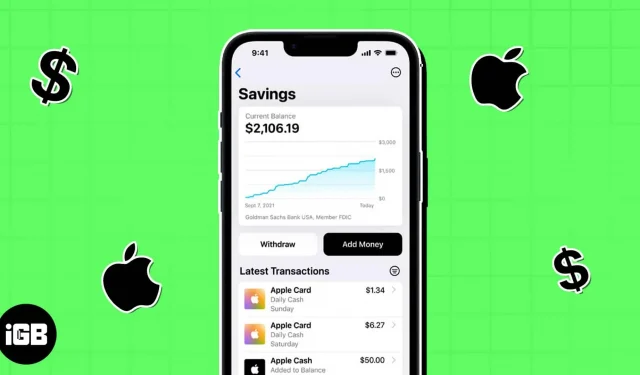

Once set up, the Wallet app provides an easy-to-use savings dashboard. You can manage and track your account balance and interest earned over time.

- Go to Wallet → Apple Card → Savings Account.

- In the “Current balance”section, you can see the total amount of savings. The amount includes all current transactions or deposits. Thus, you cannot withdraw the entire balance.

- Tap the three dots icon → Account info.

- It shows your available balance for withdrawal and your current APY with the interest you have earned so far in the current year.

How to deposit money into an Apple Savings Account

- Go to Wallet → Apple Card → Savings Account.

- Click Add Money.

- Enter the amount you want to deposit → select “Add”.

- Select or add a payment source, such as an external bank account or Apple Cash.

- Confirm the transaction with Face ID, Touch ID, or a passcode.

Easy, right? While Apple Cash funds are available instantly, transactions from an external bank account often take several days. Therefore, it is best to deposit them in Apple Savings, where you can earn interest from the day you add the amount to the Wallet app.

How to withdraw savings money

To spend money from a Savings Account, you must transfer it to your Apple Cash wallet or to an external bank account linked to the Savings Account.

- Open Wallet → Apple Card → Savings Account.

- Select Remove.

- After entering the desired withdrawal amount, click “Next”.

- Select Apple Cash or an external bank account.

- To confirm using Face ID, double-click the side button.

It usually takes 1-3 business days for the deposit to be credited to your bank account. Funds are instantly available in Apple Cash for spending.

How to Manage Your Apple Savings Account

From the Wallet app, you can easily manage your Apple savings information.

- Go to Wallet → Apple Card → Savings Account.

- Tap the three dots icon → Account info.

- To change Savings mailing address: Select Account Information → Update mailing address.

- To add a linked external bank account: Click Bank Accounts → Add Another Bank Account. Then follow the instructions on the screen.

- To remove a linked external bank account: Click Bank Accounts → Edit. Select “Delete”next to the bank account, and then click “Done”.

- Adding or removing a beneficiary. Select “Account Information”→ “Manage Beneficiaries”. You can consult a savings account specialist at the support number.

Export your Apple savings account statement and tax information.

If necessary, you can export your Apple Savings account statement and tax information. Your monthly savings report, which summarizes your account activity during the reporting period, will be available on the first of each month. In addition, for users with reported income, tax documents are available until January 31st.

- Open Wallet → Apple Card → Savings Account.

- Tap the three dots icon → Documents.

Benefits of an Apple Savings Account

- Apple Card holders receive 3% per day when using Apple Pay at Apple and a select group of retailers such as Uber and Uber Eats, Walgreens, Nike, Panera Bread, T-Mobile, ExxonMobil, and Ace Hardware, as well as 2% per day. Cash with Apple Pay at other retailers and 1% on all other purchases.

- So, you can amass a big fortune using Apple Savings thanks to the 4.15% interest rate compared to Daily Cash.

- It also provides high privacy and protection since the functions are integrated into the dynamic control panel in the Wallet app.

- Best of all, Apple goes the no-fee route. There are several savings account products in the financial market with monthly maintenance fees, minimum monthly balances, and minimum initial deposits required to earn certain interest rates. In contrast, Apple claims that there will be “no fees, no minimum deposits, and no minimum balance requirements”for its Apple Savings Account.

Thus, an Apple Savings Account might be the right choice for you if you found that your current savings account was nickel-plated and reduced your money.

FAQ

You may not be able to set up a savings account if your Apple Card account is restricted or frozen. You must contact Apple Support to access your savings and transfer money.

Apple offers two ways to deposit money into your Apple Savings Account. The former allows users to deposit Daily Cash into their new savings account from their Apple Cash card. Another method is to connect external bank accounts to move funds.

First, transfer all account balances to Apple Cash or to your bank account. Then contact an Apple Support savings account specialist to close your account.

Boost your financial well-being!

Creating an Apple Savings account is an easy and convenient way to manage your finances and save for future goals. With an easy-to-use dashboard, seamless integration with other Apple payment services, and strong security measures, you can trust your savings to Apple financial services with confidence.

An Apple Savings Account can help you reach your financial goals with high-yielding interests. So go ahead, take advantage of this convenient and secure savings method from Apple and watch your savings grow!