Small businesses are cutting marketing spending due to Apple’s sweeping privacy changes that have made it harder to find new customers online, a growing trend that has resulted in billions of dollars in revenue losses for platforms like Facebook.

Last year, Apple began forcing app developers to get permission to track users and show them personalized ads on iPhone and iPad, which has changed the online advertising sector.

Many smaller companies that rely on online advertising to reach new customers told the Financial Times that they didn’t initially see the full impact of Apple’s restrictions until recent months, when price inflation sapped consumer demand in major markets around the world.

This has led companies to suddenly cut their marketing spend to save money, and also found that targeting potential consumers is prohibitively expensive, as they used to be.

The challenges that small businesses face have resonated with the online advertising giants as well. Facebook, Snap, Twitter and YouTube are estimated to lose $18 billion in revenue this year due to Apple’s changes, according to ad tech company Lotame. Facebook parent company Meta has been particularly hard hit, saying earlier this year that Apple’s changes cost it at least $10 billion.

“Personally, I haven’t felt the same impact of Apple’s changes in 2021 as we did in 2022. This year has been brutal,” said Nadia Martinez, founder of Kallie, a California-based handmade shoe company she launched from her laundry. room 2014

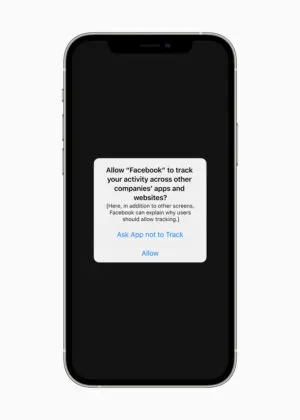

Tracking confirmation mockup that Apple posted on its company blog. Note that Facebook is used as an example.[/ars_img]Martinez has been so successful at marketing on Facebook that she started an agency to train other women on how to be online entrepreneurs. But some of these businesses are currently out of business. “Advertising has become more expensive, we have less access to data, and it is no longer as effective as it used to be,” she said.

Varos, a data-sharing platform that helps e-commerce groups, analyzed data from 1,300 small businesses and found that the decline in revenue accelerated every month in the second quarter, leading to a 13 percent drop in June, the worst decline this year. At the same time, the cost of acquiring new customers through online advertising is “significantly higher” this year than last year, and overall Facebook ad spending is “substantially lower” this year.

“You used to be able to invest in Facebook — you put in $1 and the $2 came back,” said Matt Schroeder, founder of Shelly Cove. “It just doesn’t exist anymore.

Smaller brands said they weren’t necessarily hit by Apple’s policy changes later than major platforms, but supply chain issues and the global pandemic created a “fog of war”that made it hard to see why, for example, last year’s holiday sales upset.

“In 2021, it was very difficult to sit back and look at the percentage change and understand why,” said Andrew Goble, co-CEO of Jambi’s, which sells unisex boxers with pockets.

As a result, many smaller brands have not changed their marketing strategies to the detriment of online advertising platforms until recently. Last month, Snap reported its weakest quarterly sales growth, Shopify laid off 10 percent of its workforce, Meta experienced its first-ever annual revenue decline, and Twitter posted a loss.

Meanwhile, Google Search and Amazon’s advertising business, which do not rely on third-party “tracking”and were not affected by Apple’s policies, flourished in the second quarter. Apple’s own advertising business, Search Ads, has also captured market share and is now expanding into other areas of the App Store.

Apple said about the privacy changes: “The user’s data belongs to him, and he must decide whether to share his data and with whom.”

Obvi, an online women’s health retailer, was among the companies that suffered a slump last November when the cost of acquiring new customers skyrocketed.

“We were leaving one of the best years possible, fully loaded and insanely profitable, and we are going to hit Black Friday and make a huge splash when everything hits us,” said Ashwin Melvani, its director of marketing.

Before Apple’s rules went into effect, Obvi spent an average of $30 to acquire a new customer on Facebook, and a customer spent about $60. Last fall, that cost tripled to $90, turning a profitable business into a loss.

Melvaney said his marketing budget is about $20,000 a day, of which 90 percent goes to Facebook. Over the past few months, Obvi has slashed its budget, redirected spending to TikTok, and refocused the company on loyal customers.

“It all boils down to Facebook losing 50% of its data,” he said, referring to the iPhone’s US market share. “This massive algorithm they created is now missing half of the information, so everything is destroyed. For example, imagine that you lost half your brain.”

Kelly Dean, vice president of marketing for Kencko, a Portuguese maker of powdered smoothie mixes, said Apple’s privacy policy had the biggest impact over the past four to six months, but added that it’s been difficult to determine its impact as ad platforms fiddle with their algorithms. in reply.

“There were a lot of platform-wide anomalies and spikes in [Customer Acquisition Cost] that we don’t really know why,” she said. “It’s terribly encouraging that it’s not just us.”

Shelly Cove’s Schroeder has slashed its digital advertising budget by up to one-third from a month earlier, hoping loyal customers will keep the business afloat. “It’s irresponsible to say, ‘Apple killed my business,'”he said. “I’m thinking about myself – I realized that I was too dependent on Facebook.”

He added: “Any small business, at least online, depends on the whims of these big tech giants. There’s just no way around it. So if they do something that deceives you, you’re screwed.”