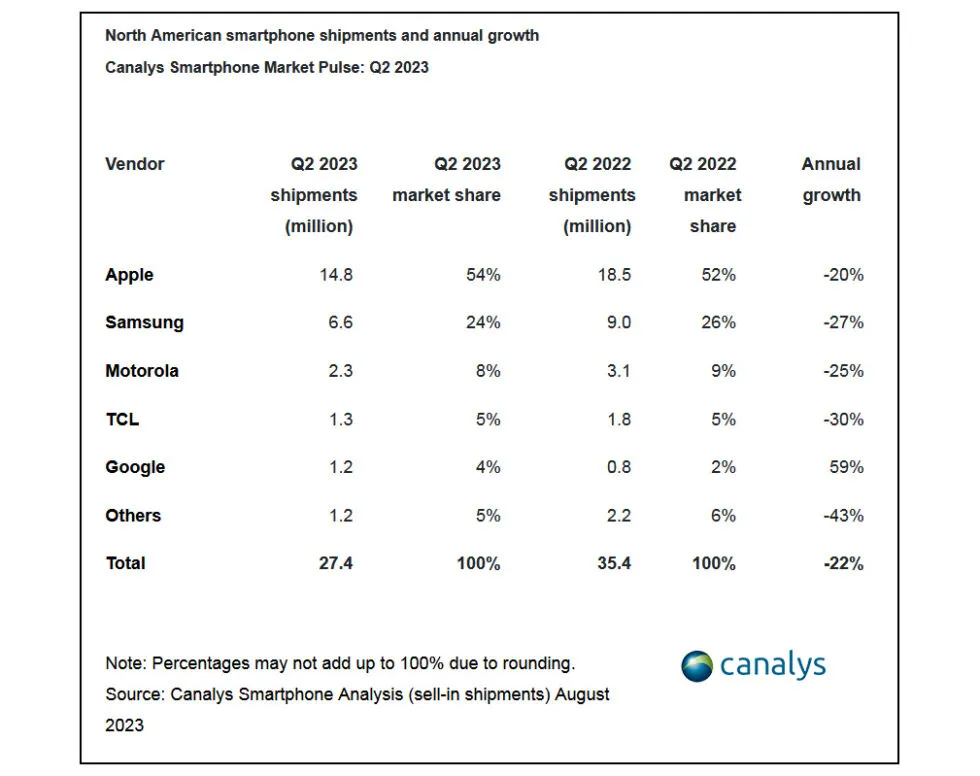

Canalys has some gruesome new numbers out for the North American smartphone market in Q2 2023, detailing what it’s calling the “worst quarterly performance for over a decade.”Q2 has plummeted 22 percent, year over year, and with these numbers, Canalys is predicting the smartphone market will be down 12 percent overall in 2023.

Apple is down 20 percent for Q2 and still in a dominant position with 54 percent market share. Samsung is down 27 percent, in second place overall with 24 percent market share in Q2 2023. Motorola is next with a 25 percent decline and only 8 percent market share. TCL, a TV company that feels like it only briefly dabbled in smartphones, is the single biggest loser, down 30 percent, with 5 percent market share.

Only a single company survived this quarter unscathed, and it’s actually Google! The company might be at the bottom of the smartphone charts, but Pixel phone sales are up 59 percent, earning Google 4 percent of the market. It was the same story last year, when Google jumped from 1 to 2 percent. In a few quarters, the company might hit fourth place.

The biggest loss on the chart is actually “others,”down 43 percent, likely representing the further consolidation of the Android market. These are your OnePluses, your HMD/Nokias, and trashy pre-paid vendors like Blu. Canalys explains some of this by saying the low-end market “will continue to struggle as prepaid demand dwindles.”The average sell price is up from $663 to $738 year over year, indicating it’s the premium phones that are selling, and all the cheap vendors are getting shut out. Despite the overall losses, Canalys says, “Apple and Samsung boosted their premium segment shipments with 25% and 23% growth respectively in Q2 2023.”

The years 2022 and 2023 were both bad for smartphone sales, down 9 and (we’re on pace for) 12 percent, respectively. Canalys expects a bit of a recovery in 2024, where it’s projecting a 3 percent increase.