Things are changing rapidly in the financial services industry, from the rise of cryptocurrencies to the growth of the fintech app category to the development of advisory bots. As financial services become more of a digital industry, social media marketing is becoming an increasingly important means of promoting the space.

Even if your organization is more traditional, social media is a necessary channel to reach younger customers. And you have to be prepared for what’s to come. Gartner found that 75% of financial services leaders expect significant change in the industry by 2026.

Here’s why (and how) to develop a financial services social media strategy this year.

1. Attract a new audience

Social media is where Generation Z goes in search of financial information. The oldest members of this age group turn 25 this year. And they start reaching milestones that deserve financial advice. 70% of them are already saving for retirement.

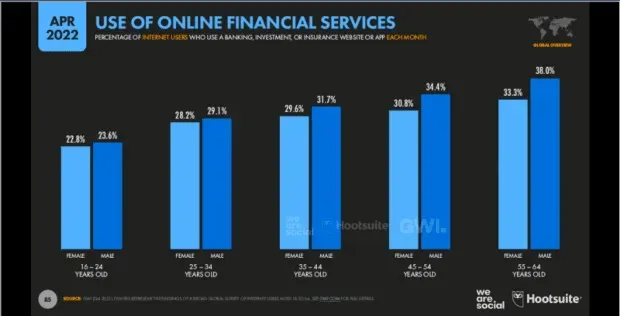

Nearly a quarter of young people aged 16 to 24 already use a financial services website or app every month. Ten percent of them already own some form of cryptocurrency.

Even if you’re not into Gen Z marketing, social media is an important channel for connecting with new customers. More than three-quarters (75.4%) of internet users use social media to research brands.

2. Strengthen relationships

Relationship building is a key use of social media for financial industry professionals. When it comes to money, everyone wants to do business with someone they know and trust.

Developing leads and customers online is known as social selling. Here is a short example of how it works:

Social media can help identify important financial moments in the lives of clients and prospects. For example, LinkedIn is a great place to learn about career changes or retirement. Tracking customer business pages can also give you insight into their problems.

However, social selling is usually about building relationships. Sales is a long-term goal.

When a connection gets a new job or starts a new business, be sure to send a congratulatory message. (Nearly 95% of social media consultants use some form of direct messaging effectively.)

Keep yourself in mind. But don’t jump in and try to sell.

It is important to focus on providing reliable information and resources. Nearly a quarter of internet users follow the brand they are considering buying from on social media. They want to follow and observe for a while before they jump.

Focus on the customer’s needs, not the sale.

3. Emphasize brand purpose and build community trust

Financial services brands must now show they are more than just financial returns.

64% of respondents to the 2022 Edelman Trust Barometer survey said they invest based on beliefs and values. And 88% of institutional investors “subject ESG to the same scrutiny as operational and financial considerations.”

Young investors are especially interested in sustainable investing. A Harris poll for CNBC found that a third of millennials, 19% of Generation Z and 16% of Generation X “frequently or exclusively use ESG (environmental, social and governance)-focused investments.”

And the Natixis report showed that 63% of millennials feel they have a responsibility to use their investments to solve social problems.

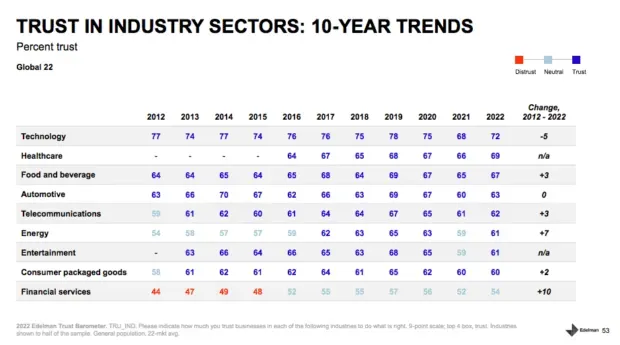

Confidence in the financial services sector has grown over the past 10 years. But according to the Edelman Trust Barometer, it’s still the most untrustworthy industry. Social media allows you to build trust and solve customer problems.

Source: Edelman Trust Barometer 2022

4. Humanize your brand

People want to deal with reliable financial experts. This does not mean that they want their financial service providers to be cold. Social media provides you with a great opportunity to humanize your brand.

Engaging your company executives on social media can be a great start. After all, it may be easier to trust a person than an institution.

Potential clients expect to see your top executives on social media. 86% of financial readers say it’s important for business leaders to use social media. They trust leaders who use social media more than those who don’t by a 6 to 1 ratio.

Of course, the tone you choose will depend on the network you’re using and the target audience you’re trying to reach.

The average consultant uses 4 social networks, while the most successful use 6. Putnam’s 2021 survey of social consultants revealed a shift from LinkedIn to Facebook. Consultants also use Instagram and TikTok all the time.

5. Get key industry and customer information

Try using social media to research the financial services industry. This is a good way to keep up to date with what’s happening in your field.

Does the competitor have a new product offering? Is there a PR disaster coming? Think of social media as an early warning system.

Listening to social media can tell you what’s going on in the industry. Here’s how it works:

You can also use social listening to learn about your potential customers and gauge what they want from you.

Also, be sure to keep an eye on social media analytics. These tools give you insight into the effectiveness of your own social efforts. You can find out what works best. Then fine-tune your social media marketing strategy for financial services clients as you go.

6. Reduce effort and cost

Social efforts work best when teams, departments, and individual consultants use social media in a coordinated way. This is most likely due to the overall social media management platform.

The content library is a valuable resource for both employees and brands. Staff have access to pre-approved content that is ready to use. Brands feel at ease when employees post consistent messages that support strategic goals.

With everything in one central library, there is no duplication of effort or cost. This pre-approved library solves two of the main social media concerns for financial advisors:

- Lack of time

- Fear of making a mistake.

7. Deliver a unified digital customer experience

As the financial industry becomes more digital, customer service should follow suit. Customers want to reach out to companies on platforms they already spend their time on. These can be social networks like Facebook or messaging apps like WhatsApp.

Social customer service tools allow you to coordinate customer service across all channels. At the same time, you can link conversations to your CRM. This helps ensure compliance with response time requirements as well as record keeping.

You can also use social media bots to answer simple customer support requests or direct users to existing resources on your website. You can even use bots to view incoming requests to connect customers with the right members of your customer service team.

Sparkcentral by Hootsuite is a useful tool for creating a unified social customer service program.

8. See real business results

Simply put, social media impacts your bottom line in a specific and measurable way.

81% of social media financial advisors say they have generated new business assets through their social efforts. In fact, social media consultants successfully report an average of $1.9 million in revenue from social media activities.

The Deloitte Global 2022 Gen Z and Millennial Survey found that young people’s optimism about their own financial situation is improving. However, both of these generations are generally still concerned about their financial security.

Source: Mood Monitor Drivers, Deloitte Global 2022 Gen Z and Millennial Survey.

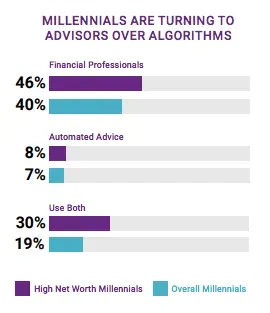

At the same time, the Natixis global survey of individual investors found that 40% of millennials and 46% of wealthy millennials want personal financial advice from a financial advisor. Social media is the perfect place to connect with these new customers.

Source: Natixis Global Individual Investor Survey: Five financial truths about millennials in their 40s.

1. Focus on compliance

FINRA, FCA, FFIEC, IIROC, SEC, PCI, AMF, GDPR – all compliance requirements can make your head spin.

It is critical to have processes and tools in place for compliance, especially for managing social media use by independent consultants.

Engage your compliance team to develop a social media strategy for financial services. They will have important recommendations on the steps you need to take to protect your brand.

It is also important to have the right approval chain for all social media posts. For example, FINRA states:

“The registered executive must review any social networking site that the associated person intends to use for business before using it.”

2. Archive everything

This falls under compliance, but is important enough to be worth mentioning separately.

According to FINRA: “Firms and their registered representatives must maintain records of communications related to their ‘business as such’.”

These records must be kept for at least three years.

Hootsuite’s integration with compliance solutions like Brolly and Smarsh automatically archives all social media posts. Your social content will be stored in a secure and searchable database along with the original context.

3. Conduct a Social Media Audit

With a social media audit, you document all of your company’s social channels in one place. You also note any key information related to each of them. At the same time, you will hunt down any scammers or unofficial accounts so that they can be closed.

Start by listing all the accounts your internal team regularly uses. But remember, this is just a starting point. You will need to look for old or abandoned accounts and accounts for specific departments.

While you’re at it, look out for social platforms where you don’t have social accounts. Maybe it’s time to register profiles there. (TikTok, anyone?) Even if you’re not ready to use these tools yet, you can reserve your brand descriptors for future use.

We’ve created a free social media audit template to help organize all your research while you’re at it.

4. Implement a social media policy

The social media policy governs the use of social media within your organization. This includes the accounts of your consultants and agents.

Contact all relevant teams in your organization, including:

- Agreement

- Legal

- THIS

- Information security

- Human resources

- public relations

- Marketing

All of these teams need to contribute. This will help you maintain brand consistency while reducing compliance issues.

Your policy will also define team roles and approval structures so everyone understands the social media posting workflow. This prior clarity may help reduce frustration that social media may not be growing as fast as some would like.

The use of social media for the purposes of the financial industry can also come with security risks. Include a section in your social media policy that describes security protocols for the less sexual aspects of social media. For example, how often to change passwords and how often to update software.

1. Current x MrBeast

Current is a financial services company that primarily offers mobile banking services through an app. To boost brand awareness, they partnered with high-profile influencers including Hailey Bieber and Logan Paul.

In particular, they have developed an ongoing collaboration with influencer MrBeast. Two of the resulting social videos ranked #1 in YouTube’s Most Viewed Videos. The campaign resulted in a 700% increase in requests for money through the Current app, making it the number 5 financial app in the Apple App Store.

2. BNY Mellon #DoWellBetter

BNY Mellon designed the campaign to highlight the positive impact of its wealthy clients. The campaign, with beautiful portraits and video interviews, showed how smart investing and asset management with BNY Mellon has allowed them to accumulate the resources to make positive change.

Telling customer stories is a good way for financial institutions to establish a human connection on social media platforms.

3. CloudTax Influence Campaign Targeting Generation Z

This Canadian tax software startup has partnered with several influencers. They primarily used TikTok to reach Gen Z audiences. Founder and CEO Nimalan Balachandran told Global News that influencer marketing has driven about a quarter of the company’s growth.

Their influencer videos reflect the unique look and feel of TikTok. This allowed them to connect with the platform’s community in a way that would not be possible with more traditional social content.

@passionstoprofits #taxseason #taxwriteoffs #taxwriteoff #taxes2021 #payyourtaxes #moneytok #smallbusinesscheck #smallbusinesstips_ #smallbusinessowner #cloudtaxpartner

4 Vanguard Group #GettingSocial

Investment company Vanguard Group uses a weekly series of social videos to share its experience in the field of investing and other financial topics.

Releasing videos on a consistent schedule trains subscribers to expect content. This encourages viewers to check in weekly and become regular viewers over time. The videos offer short, easy ideas. They don’t require a lot of time from busy followers.

They also run social ads that cover similar topics. This gives social media users access to educational and conversion-focused content that works in tandem.

5. Penn Mutual: Content Library for Consultants

Penn Mutual has a dedicated content studio in the marketing department. They produce, test and improve the social content that forms the backbone of the Consultant Content Library.

The social team adjusts content to suit different audiences. They then add it to the content library for financial advisors to customize and share. They use Hootsuite Amplify to make the sharing process possible with just a few clicks or taps.

Every Friday, the company sends out a list of new content that consultants can post or schedule.

Hootsuite makes social marketing easy for financial services professionals. From a single dashboard, you can manage all your networks, increase revenue, deliver customer service, mitigate risk, and ensure compliance. See the platform in action.