Taiwan’s Semiconductor Manufacturing Company plans to increase its capex by nearly a third this year as the world’s largest contract chipmaker ignores analyst warnings of declining demand for tech gadgets.

TSMC expects capital spending to reach $44 billion this year, up 32% from the $30 billion spent in 2021 and tripling from 2019, the company said on Thursday.

This push highlights the huge role of semiconductors in products that go far beyond classical electronics, from automobiles to factory equipment. It also reflects TSMC’s dominance in global chip manufacturing.

TSMC’s scale of spending will also put a ceiling on the ambitious plans of Samsung, TSMC’s closest competitor in contract chip manufacturing, and Intel, which has also entered the foundry business to challenge the Taiwanese company’s lead, said Semianalysis’s Dylan Patel.

“It will be difficult for Intel and Samsung to keep up with the scale that TSMC is planning,” Patel said in a research note Thursday.

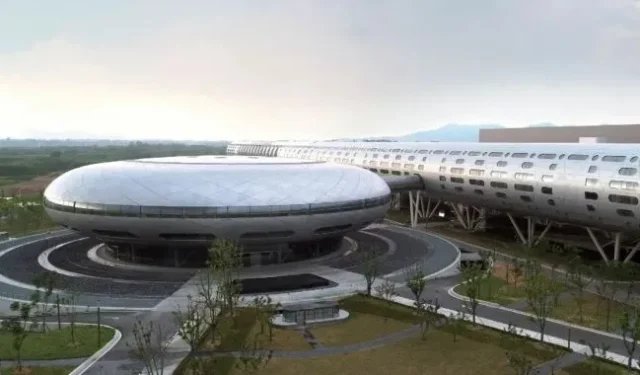

TSMC has built a large advanced 3nm chip manufacturing facility in southern Taiwan, a technology level that is scheduled to begin production later this year. He is also building a new factory to produce at 5 nanometers, the most advanced level of technology currently used in the US.

The company said the expansion is necessary because demand for its chips will continue to grow at double-digit margins in the coming years, although some analysts are predicting a slowdown after a growth spurt in the past two years.

“We are seeing that end-market demand may decrease in units, but silicon content is increasing,” said Xi Wei, chief executive of TSMC. “So even if there is a slowdown, we believe it could be less volatile for TSMC. Therefore, we expect our capacity to remain very limited throughout 2022.”

The company forecasts that its revenue will grow by at least 25 percent this year. Had TSMC achieved this goal, it would have outperformed the broader growth of the chip contract manufacturing industry by at least 5 percentage points and would have grown three times faster than the broader semiconductor market.

Many analysts warn that growth in technology demand will level off, especially in the smartphone segment, which accounts for the lion’s share of TSMC’s revenue.

Christine Lau, of technology consultancy Third Bridge, said: “2021 has certainly been a very big moment, even if we look at the past decade.”

She added that recent lower demand forecasts this year from Chinese smartphone brands will impact both MediaTek, a Taiwanese chip company that supplies most Chinese smartphone makers, and TSMC.

TSMC’s bullish outlook comes as the company reported a 16.4% increase in net income to NT$166.2 billion ($6 billion) in the fourth quarter of 2021 from a year earlier on a 21.2% increase in revenue.

“It’s [market share] growth, it’s pricing, it’s unit growth,”TSMC’s Wei said.

A year ago, TSMC stated that it believes the chip industry is entering a multi-year period of structurally higher growth rates driven by the proliferation of semiconductors in various industries and areas of human life and increasing computing density.

These trends, which are reflected in the launch of 5G telecommunications services, the use of artificial intelligence in everything from entertainment to factory automation and autonomous driving, have boosted demand for TSMC chips to the point where it needed to ramp up capacity faster. the company said.

The pandemic has given an extra boost by creating an unexpected demand for the tech gadgets needed to work from home. Together with global production and logistics disruptions and planning disruptions due to the pandemic, this surge in demand has resulted in persistent chip shortages, giving TSMC even more leverage in the market.

The company has raised prices and required many of its customers to pay up front to secure bandwidth, which was rarely used until last year. The company received $6.7 billion in such prepayments in 2021 and expects that amount to increase even more this year, chief financial officer Wendell Huang said.

Driven by strong demand and full capacity utilization, TSMC’s gross margin reached 52.7% in the December quarter and is expected to top 53% this year, a level that management says can be sustained in the long term.